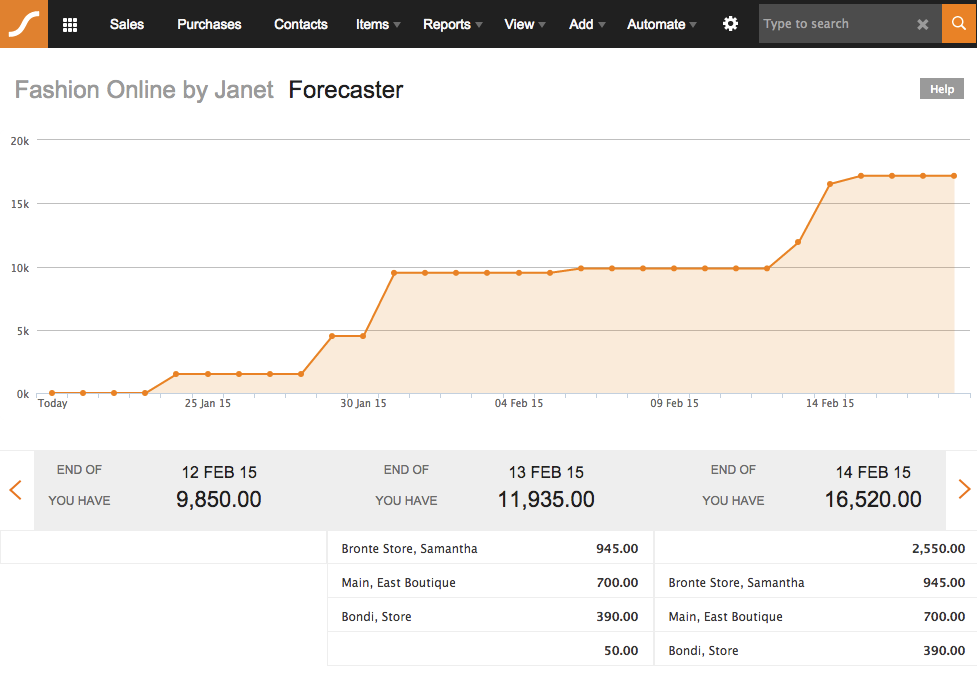

Our online accounting cashflow forecaster gives you a combined view of what will happen across all your bank accounts over the next 90 days. It is entirely forward looking. Column 1 is today, column 2 is tomorrow etc. There is also a column that shows overdue sales & purchases. That way you can do things like predict your cash balance when a customer pays an overdue invoice.

What online accounting transactions show up?

Any transaction that hits a bank account will show up e.g. sale payment, pays, expenses and more.

Transactions expected to hit a bank account in the future will show up on that expected date e.g. an unpaid sale, your next pay run, recurring purchases etc.

All online accounting transaction types, with the exception of bank transfers are included.

- Unpaid sales/purchases

- Orders but not Quotes or Opportunities

- Sale/purchase payments

- Journals

- Bank Transfers

- Recurring sales/purchases

- Pay runs but not individual payroll entries

Why does a transaction show up on that date?

Cashflow forecaster uses lots of logic behind the scenes depending on the transaction type. For example we will use the due date on an unpaid sale to begin with however we use many other rules to help get the best possible predicted date. This is our online accounting “secret sauce”!

Why can’t I move those grey transactions?

There are two types of transactions that cannot be moved, actual and forecasted:

- Actual transactions such as payments, journals, payrolls. These have happened so they cannot be moved.

- Forecasted transactions such as recurring sales/purchase and pay runs. These are actuals in the future e.g. next weeks pays.

Remember Forecaster shows a future where predicted transactions have already happened. e.g. in Forecaster a recurring sale that will be created next week with a payment applied 3 days later has already happened. Therefore it shows up in Forecaster.

How can I use this to plan?

Cashflow Forecaster is malleable. You can move one or more transactions to another date in your online accounting file to see what will happen to your future cash position. This allows you to see what happens if you get paid late, if you pay someone late etc. Also remember you can change transactions like a recurring sale and we will reflect that updated setup in Cashflow Forecaster instantly.

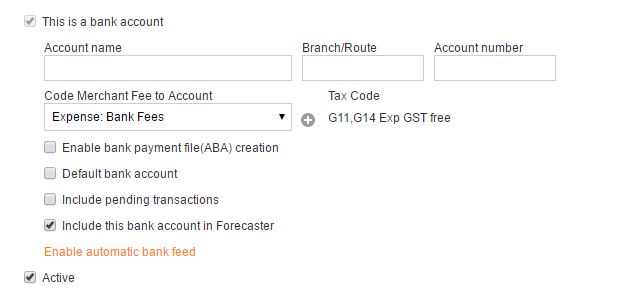

How do I exclude a bank account from Forecaster?

Navigate to the edit Bank Account screen and un-tick the option shown below. An example of an account you may want to exclude could be a Directors Loan account that you have setup as a bank account.

What makes up the forecast value?

The “you have” amount is the bank accounts opening balances for today plus the net of transactions for the day. So it’s super important to have your bank accounts reconciled as close to today as possible.

Foreign currency transactions are automatically converted to AUD in the forecast. This provides you with a single understandable figure.

Can I access Cashflow Forecaster on the mobile app?

Yes. If you are using version 1.0.17 or higher of the iOS or Andriod apps you can view the Forecaster report for either 1 month or 3 months as a line graph. Any movement of predicted transactions will still need to take place on the web app.

Why am I getting “Access Denied”?

To access Cashflow Forecaster you need to have FULL access to the following in your user role. We are using all of these to generate the forecast. Therefore we don’t allow access unless you can see a complete forecast.