To capture Salary Sacrifice in Saasu there are two areas to address.

Before continuing with these we recommend confirming how the Salary Sacrifice is to be treated in a tax sense with your employee and advisors as this pay item type has a “Taxable” setting that impacts the tax payable by employees using it.

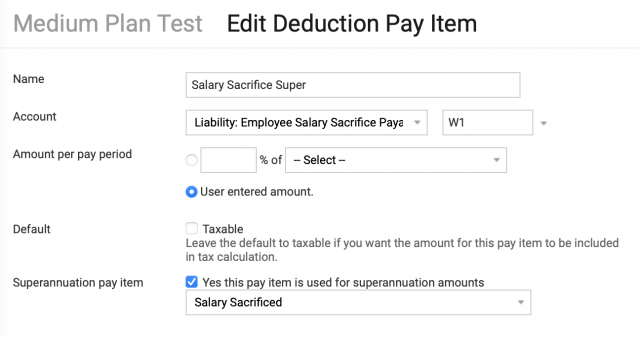

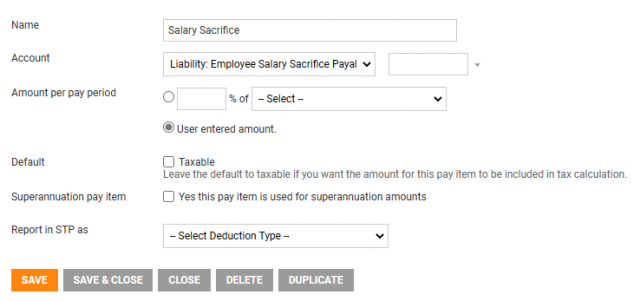

Confirm the setup of you Salary Sacrifice Pay Item

Go to Settings (Cog Icon) > Settings for this file > Scroll down to the Payroll section and click Manage Pay Items.

IMPORTANT: You need the Tax flag unticked if the intention is to have the employee receive a Salary Sacrifice tax benefit.

Example 1: Salary Sacrifice Super

Example 2: Report in STP

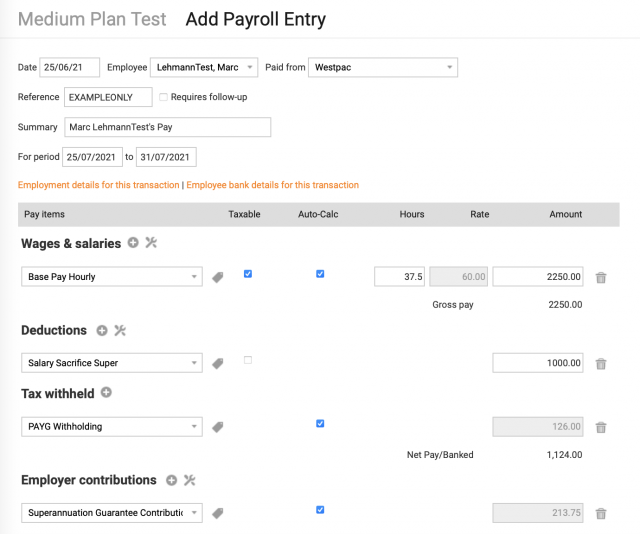

Entering pays that have Salary Sacrifice

The following example payroll entry shows you the Salary Sacrifice Deduction entered. Noting in this example the automatically calculated PAYG Withholding tax was reduced because $1,000 was deducted from the Wages and Salaries Pay Item(s). That is, the employee is getting a tax benefit of Salary Sacrifice.

FAQ’s

My old pays are wrong as I didn’t have the Salary Sacrifice Pay Item set up correctly?

If you wish to update them you can either create an adjusting pay -or- re-save each pay that uses this Pay Item . If the Tax amounts change this may trigger the need to resubmit a BAS if already submitted for the period the pays updated are in. This is because the PAYG Withholding amounts may have updated on those employees affected.