If you find a mistake on a pay event that was already submitted via the STP report and accepted by the ATO, then there are two ways you can make an adjustment.

Create adjusting entries on the next pay

If you identify an error for a previously submitted Regular Pay Event on an individually created Payroll or a historical Pay Run, then you can add a correcting line item on the next pay for the employee concerned. When you submit this entry in your next Regular Pay Event, this will then be picked up.

This help note explains how to fix payroll mistakes.

Replace ATO Pay Event via STP

You are able to use the option Replace ATO Pay Event if:

- You haven’t already paid the employees and given them a payslip.

- The previous Regular Pay Event you submitted was for a Pay Run

- The Pay Event you need to replace is the most recent Pay Event and has previously been fully or partially accepted by the ATO.

- The Pay was originally uploaded in the last 24 hours ideally. If longer than this the ATO may still accept it but it isn’t as certain.

To replace a previous pay event you will need to:

- Delete the recent Pay Run that has the error (the whole pay run needs deleting as you’re unable to delete just the pay in error)

- Re-run the Pay Run for the correct date and date range with the necessary corrections (Note: if the Pay Date is different, the replacement option will not work. This only applies to fixing a Pay Period error)

- Run the STP report and choose the Replace ATO Pay Event

- Check that the information for submission is correct

- Click Submit

Important Notes:

- You can’t make an adjustment by Replace ATO Pay Event (known as full file replacement) if any employee information submitted in the original pay event file has been changed by a subsequent pay -or- you are adding employees. This should be done by Manual Pay(a) and submit Manual Pay Event(s).

- Replacing the ATO event may affect the amount W1 automatically reported in your BAS. Just need to check that the W1 amount matches your BAS report in Saasu before you submit the BAS to ATO. As replacing doesn’t feed through it will double it, as you’ve now put it in twice.

Replace your Finalisation Event via STP

If you need to amend details after making a Finalisation, you should do this resubmitting your Finalisation. This allows updated information to flow through to your employee in the ATO online services they access. Notify your employee of any changes because they may need to correct their tax return if they used the previous information if it was incorrect.

Ideally should correct errors before you are due to lodge your next Pay Event. i.e. within the period of you pay cycle. However, you can amend finalised information reported through STP up to five years after the end of financial year per the ATO’s website. We strongly recommend checking all Finalisation amendments with your accountant before processing as we are only able to provide general technical use herein.

When you’ve lodged the new Finalisation with the correct details, revise the PAYG withholding information (labels W1 and W2) on your activity statement for that period.

To make a new Finalisation declaration via Saasu’s STP report:

- Make correction to payroll such that you are seeking and follow any reconciliation and accounting procedures you have to verify your corrections.

- Go to Reports > Single Touch Payroll

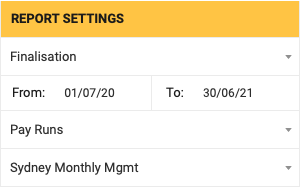

- Select Finalisation and set the filters for date range to be the financial year it relates to (or portion of a year for Departing Employee). See the screenshot below as an example.

- Click Run and then check that the information for submission is correct.

- Click Submit and follow the prompts to make the declaration.

- Once accepted by the ATO (may take up to 48 hours) check with your employees that the correction has flown through to their year end tax records.

- When you’ve lodged the new Finalisation with the correct details, revise the PAYG withholding information (labels W1 and W2) on your activity statement for that period if they have changed.