Sometimes businesses and individuals sell stock on a consignment basis. Consignment is the act of consigning, which is placing a person or thing in the hand of another, but retaining ownership until the goods are sold or person is transferred. This may be done for shipping or for sale in a store (i.e. a consignment shop).

Supplier selling on Consignment

You want to track the stock you have for sale on consignment at your customers’ selling locations. One way to track this stock movement is to use an Inventory Transfer to move the stock you are selling on consignment from the Asset: Stock Account to Asset: StockConsignment. Your stock is moving location even though legally you own it and retain the title until it is sold, so it needs to stay in the Asset Account.

An example of moving stock to a consignment status

- Set up Asset: Stock and Asset: StockConsignment accounts.

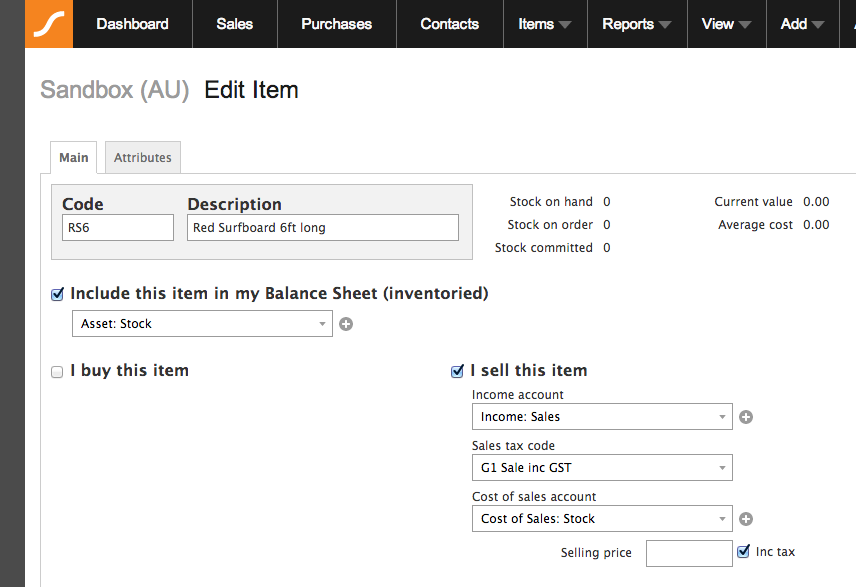

- Set up an inventory item for normal stock and save the transaction.

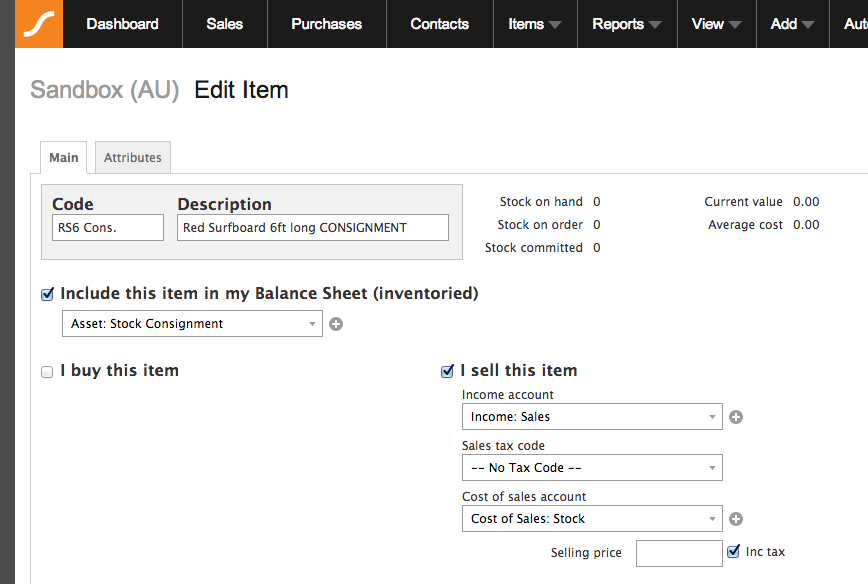

- Click Duplicate.

- Change the item code and description to include “Consignment”.

- Change the asset category to Asset: StockConsignment.

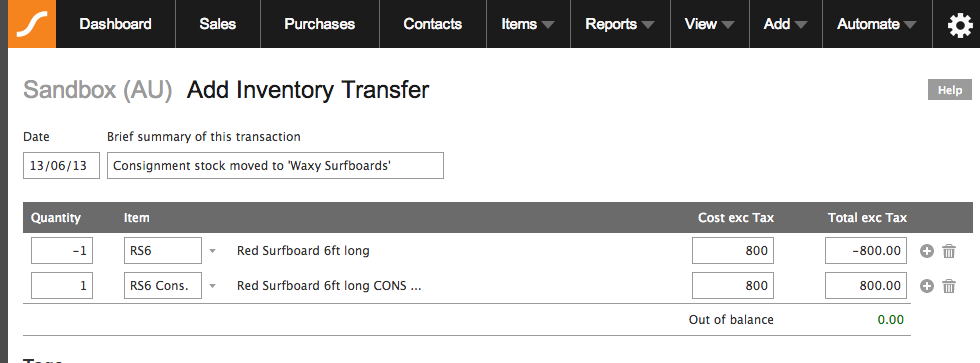

- Transfer the stock from Asset: Stock to Asset: StockConsignment. This transfer represents “change of physical control” (but not title).

- When you sell the stock, use the consignment inventory item in your sale. If the stock isn’t sold, simply reverse the above transfer when the goods are returned to you.

Retailer selling stock on consignment

If you sell stock on consignment for a supplier (or customer selling their second hand goods say). Then the following approach can be used to track these goods in your business.

NOTE: Please check the process with your accountant to be sure it fits your tax and legal arrangements that relate to your specific method of consigning stock.

An example of holding stock on consignment ON balance sheet:

- Set up Liability: Stock and Liability: StockConsignment accounts.

- Set up an inventory Item for consignment stock much like you would normal stock items in your business except reflect the fact that this will be Consignment stock in the Item Code and Item Description you choose e.g. Item Code: SC and Item Description: Surfboard (Consignment). Change the Asset category to be Liability: StockConsignment.

- When you sell the stock, use the consignment inventory Item in your Sales Invoice. If the stock isn’t sold, simply reverse the above transfer when the goods are returned to the supplier you are selling for on consignment.

An example of holding stock on consignment OFF balance sheet:

- Set up an inventory Item for consignment stock much like you would normal stock Items in your business except reflect the fact that this will be Consignment stock in the Item Code and Description you choose e.g. Item Code: SC and Item Description: Surfboard (Consignment)

- When you receive the stock from your supplier, set the type field to be Purchase Order. This has the effect of bringing stock into your business as “Ordered” without it appearing on your balance sheet.

- After selling the stock as a Sales Order you can then convert the original Purchase Order to be a Purchase Invoice by changing the Type field in the transaction. This puts stock into your business on balance sheet because you now have the committed Sale.

- Then when the customer picks up their goods you can convert the Sales Order to Sales Invoice which has the effect of selling the stock off the balance sheet.