The Profit & Loss or income statement lists your sales, expenses, income and cost of sales accounts.

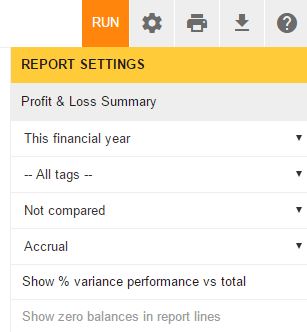

In Saasu, you can run the Profit & Loss either in Detail or Summary. You can also select to run the report in Accruals or Cash basis.

The Profit and Loss Summary report gives you the net position of your business from an income versus expenses perspective. Not to be confused with cashflow and equally not to be considered as an indicator of liquidity it has specific uses and value based on how you read into it. Typically the Profit and Loss report:

- summarises your year-to-date earnings.

- shows all amounts without consumption tax (GST/VAT/TAX).

- is calculated on an Accruals or Cash Accounting basis depending on your need.

The options you choose on the filter settings appear at the bottom of the report. If you want to change these filters, click the Cog wheel at the top of the report.

Transactions excluded in the Profit & Loss Report

- Sales and Purchases with status “quote” or “order”

- Inventory Item purchases marked as “Inventory” that have been bought but not sold. The inbuilt account “Cost of Sales: Raw Material Expenses” is used to report these transactions.

- Bank Transfers

- Inventory Adjustments, Transfers, and Opening Balances