Accounts allow you to track the movement of money, classify and group transactions. The name is comprised of a Type and Description such as Expense: Telephone. Accounts also make up your Chart of Accounts (COA) as your Advisors might refer to it. There are three types of accounts in Saasu:

Account (for categorising)

You apply an Account to a transaction when you create it. That way Saasu knows what it’s for and where to put it in reports and lists. Example: Income: Consulting fees or Expense: Telephone

Bank Account (for payments)

These may include any credit card, loans, savings and cheque accounts, as well as store/retail credit cards. You may also include Trust or similar accounts where transactions are conducted on your behalf. In Saasu these are collectively called “Bank Accounts”. They are used when entering payments. Example: Liability: ANZ Credit Card or Asset: Cheque Account

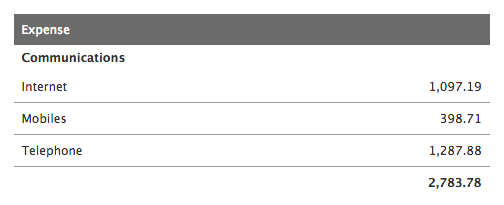

Header Account (for reporting)

You create header accounts and assign multiple Accounts to it so you can use it to add up multiple Accounts in your Profit and Loss Report. A Header Account might be called Travel while the Accounts belonging to it might be Airfares, Motor Vehicle and Taxis. Example: Expense: Travel or Income: Sales

Within your account creation, you can choose the Header Account you want to put this Account under. Note if you are creating this account as a Header account then this option won’t be available.

This capability also allows advisors and business owners to set account hierarchy and naming in line with regulatory or statutory accounts compliance needs. Some examples are:

- Assets > Bank, Current Assets, Non-current Assets, Fixed Asset, Inventory.

- Liability > Current Liability, Non-current Liability, Directors Loans.

- Expenses > Depreciation, Direct Costs, Travel, Communications, Fixed Costs.

What can you do with Header Accounts:

- Header (parent/hierarchy) accounts for Summary Profit and Loss.

- Import/Export header accounts and detail accounts.

- Assign existing accounts to a header account.

- API supported for Get, Post, Update, Delete or Listing

Don’t need header accounts? Don’t worry, your reports will be the same.

How to Add an Account (for transactions)

- Go to Add > Account

- For header accounts, Select Level to be “Header”

- Select a Type

- Enter a Name

- Select a Tax code. For example if you pay GST on your phone bill this might be G11 GST Expense

- Select a Header Account if you want this added up into a higher level Account. For example Expense: Communications (you may need to create your header accounts first that you want to use)

- Click Save

For Bank accounts, during setup:

- Tick the This is a Bank Account option

- Enter your Account Name, Branch and Account Number (NOTE: If this is a Merchant facility account also select the account you want to expense your merchant fees to and the tax code the merchant charges you).

- Tick Enable bank payment file (ABA) creation if you plan to pay multiple suppliers or employees via bulk EFT with this Bank Account

- Tick Default bank account if this is the most frequently used account in your Accounting

- Tick Include this bank account in Forecaster if you want us to help you work out live cashflow position including the balances from this Bank Account

- Click Save

More about Fields in the Accounts screen

Types of coding/allocation Accounts

- Income – For Accounts that track any income streams you have. Income accounts may include consulting fees, rent, bank interest, or profit made on investment sales (such as the sale of shares or an investment property)

- Expense – For accounts that track any expense types you have. Expense accounts may include stationery, land rates, maintenance and repairs etc.

- Asset – For accounts that track your assets. These may include your house, fixtures and fittings

- Equity – Used for capturing retained earnings from prior years, owners and shareholders capital.

- Liability- Liability accounts.

- Other Income – Often used for interest receipts and tax credits.

- Other Expense – Often used for interest expense and tax payments.

- Cost of Sales – Used by the inventory system for tracking the cost of goods and services for making a sale.

The naming of Accounts

The descriptive names usually given to Accounts are common names like “Telephone”, “Rent” or “Sales”. This is the descriptive name can also be for Accounts which often refer to the accounting methodology. As an example “Pension Payable” implies the account is used to hold money pending payment to a Pension Fund.

Default Tax Code

Allows you to set a tax code that you are most likely to use when selecting this account code. It saves key strokes and can increase accuracy. It’s best not to set a default for Accounts that vary significantly in their use such as Expense: Sundry Expenses

Ledger Code

Accounting software systems usually provide for a ledger code to allow segregation of transaction flow at different levels. Typically older style software accounting systems are dominated by ledger codes rather than using plain language like Saasu does.

Providing the ledger code also allows people to migrate to Saasu and map their old ledger code to their new Saasu simple language code. The Ledger Code isn’t used in Saasu to generate reports.

In-Built Accounts

In-built Accounts that cannot be edited or deleted because they are required by the online accounting engine for other processes and features that you may use now or in the future as your business grows.

Journal entries often occur automatically behind the scenes that use these in-built Accounts. One common example is when you create a Sale a journals between the in-built Accounts Receivable Account called Asset:Accounts Receivable and the Income Account you chose for the Sale. Later When payment is applied a further Journal between the Bank Account you selected and the same Accounts Receivable Account is created.

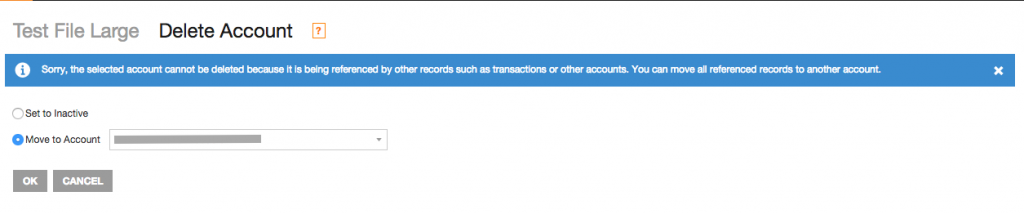

Inactivating, Deleting or Merging Accounts

To inactivate an account, select the delete icon within the account. You can then choose to delete or set this account to Inactive. If any transactions are referencing this Account you are deleting, you will be given the option to either set it to inactive or move to a different Account.

FAQ’s

Looking for Accounts Set to Inactive

For Accounts that you have previously used when entering transactions but you no longer do regular business with, you can make these inactive. You can view this list on View > Accounts then select Show Inactive.

By placing Accounts in the Inactive list, these Accounts do not appear in the drop-down lists for adding new transactions. They will however appear in the Accounts list when you are editing a transaction that still references this particular Accounts. They will also appear in relevant reports as well.

You can later re-activate the Account by clicking the Edit icon next to the Account and ticking the “Re-activate this Account” check box and saving the Account.

Looking for In-built Accounts

To perform some more advanced functions, Saasu uses some Accounts that are built-in. These Accounts are listed here so that you know you don’t need to created these Accounts yourself.