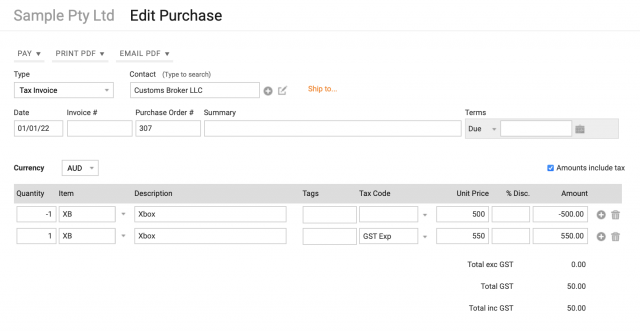

Often business who import inventory later receive a Customs and Freight broker charge for GST and possibly other items such as Freight and Insurance. To adjust your original Purchase to add these landed costs we need to add a Purchase transaction for the Customs and Freight Broker.

Essentially the first line is removing the stock from inventory and the second adds it back in with GST. This generates a Tax Invoice with the Customs and Freight broker that is for the GST component only which is what you are trying to achieve. Freight and insurance may be on their invoice also and you would add these as extra line items in this Purchase.

Make sure you have an inventory item setup for Freight and another for Freight Insurance if needed.