In the latest release of Single Touch Payroll Phase 2 on 1st March 2022 we introduced the Medicare Levy Surcharge (MLS) option in that pick-list to facilitate reporting of the “Tax Treatment Code”.

Generally employees who are above the MLS income threshold that have private heath cover don’t have to select anything for the Medicare Levy field in Saasu.

If your employee does not have private health insurance and is not paying MLS in each pay period because they are under accounting advice to leave it until tax return time to address this, then they don’t need to select the Medicare Levy Surcharge option.

You should not need to change your employee details in Saasu in most circumstances for STP Phase 2.

Paying the MLS via regular payroll transactions

We don’t support automatic MLS calculation in Saasu but we can facilitate this if you have employees who want to withhold additional tax for MLS instead of leaving this to their accountant at tax return time.

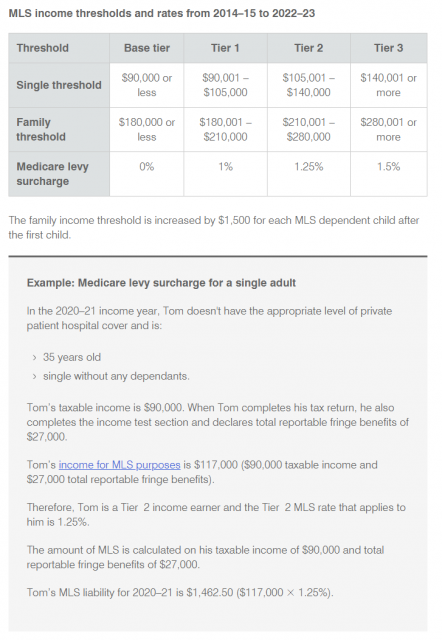

So, using this example from ATO website:

https://www.ato.gov.au/Individuals/Medicare-and-private-health-insurance/Medicare-levy-surcharge/Income-thresholds-and-rates-for-the-Medicare-levy-surcharge/

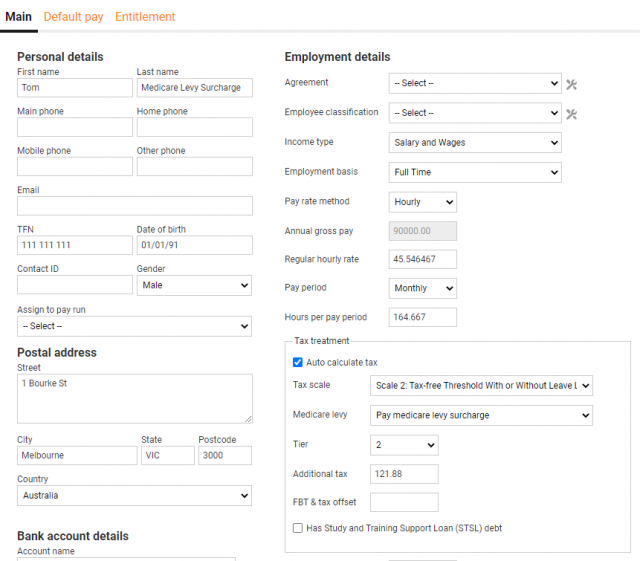

This is how we might set it up in Saasu, if your employee is paying MLS in each pay period (instead of leaving it at tax return time):

* MLS amount per month = $1,462.50 / 12 = $121.875.

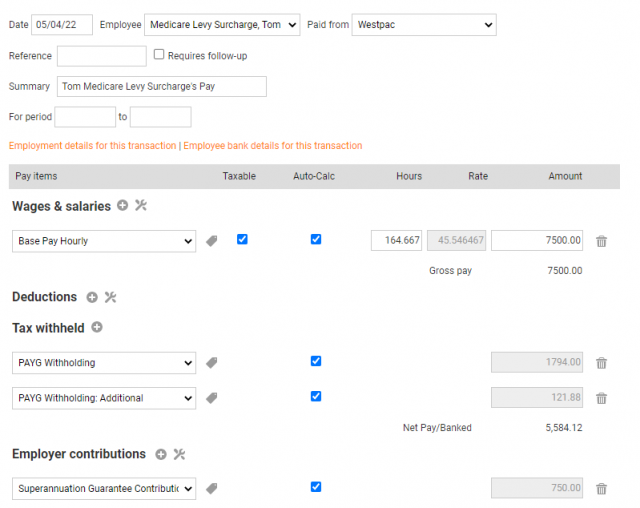

The payroll entry might look like this: