Sometimes businesses agree to sell goods before they actually have them. Consequently, when you use an inventory system that stores stock as an asset, this poses a problem because the effect can be negative inventory. Drop shipping, eBay sales, and pre-ordering can all lead to this situation.

If your transaction practices follow a fairly standard process in day-to-day commerce, it shouldn’t ever be an issue. If you try to create a sale for goods you don’t have yet, most accounting systems will stop you, as does Saasu. It does this because it expects a different workflow.

Accounting systems expect a sales order first, and to see that change to a sale later when a trigger occurs for you to change its status. In Saasu, this is the first drop down in the Add/Edit Sale screen. Changing a Sales Order to a Sale moves any deposit to income and accounts for Sales/GST/VAT tax to be payable.

For example, the trigger could be the receipt of goods from the supplier or the delivery of goods to your customer. It depends on your workflow and accounting procedures, and how they relate to laws and regulations regarding ownership and transfer of ownership in your tax zone.

In Saasu you can only run negative inventory (other than the approach mentioned above) if your inventory items are set to Buy and Sell, and do not tick Include this item in my Balance Sheet (inventoried). You can only untick this at the setup stage of the item and not after transactions have been entered.

An inventory system can’t operate on negative inventory because it would send Asset: Stock account into a negative balance, which the accounting profession doesn’t like. Consequently, some people don’t run inventory as assets but instead they trade their stock through Income and Expense account Buy and Sell options only). Again, this is a different accounting/tax method, so check with your accountant before making these decisions.

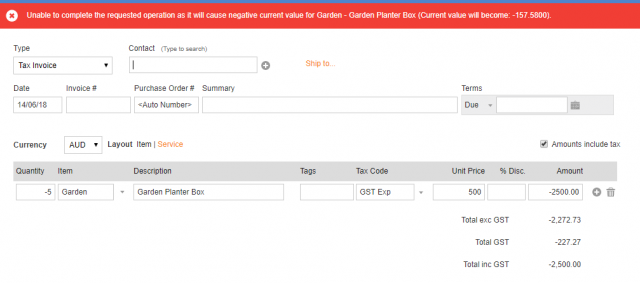

Negative Current Value Errors

Sometimes editing a transaction associated with an inventory item might not be allowed in Saasu.

Example of a situation where Saasu will tell you:

![]()

What causes this example is as follows:

- Add an Item into your system, such as Garden Planter Box

This item currently has not been purchased before which means no stock value or average cost - Buy 20 x Garden Planter Box via a Purchase Invoice at $300 each

This Item now has the following:

On Hand : 20

Current Stock Value : $6,000.00

Average Cost : $300.00 - Sell 20 x Garden Planter Box via a Sale Invoice for $500 each

This Item now has the following:

On Hand : 0

Current Stock Value : $0.00

Average Cost : $0.00

(average cost is $0 again now because we have no widgets left and have booked $500 cost of sale and profit to the accounts with journals in our business logic layer).

At a later date, you want to update the invoice at step 2, to increase the cost of your Purchase price from $300 per unit, to $450 per unit.

Changing the unit price to $450, will mean that our value for this stock was actually $9,000 rather than $6,000.

As this stock has already been sold with the existing average cost and stock value, this will attempt to put the current value for this item to negative $3,000.

Why can’t Saasu just allow me to change this and accept the negative value

Saasu can’t allow negative inventory values because this doesn’t make financial/accounting sense in a perpetual inventory system. If we allowed this and ignored the accounting logic, we would need to remove and add back all the more recent transactions in the correct order. This would create new Income and Cost of Goods sold entries in the ledger for all those transactions. In other words, we might upset the integrity of the accounting and tax reporting if, for example, commissions, P & Ls, or tax remittances based on this data had since been executed on.

Can I force this in? I don’t mind that the accounts are affected.

Yes, you can following one of these approaches:

- Save the original sale on your computer as a PDF for reference, then delete the sale invoice at step 3.

- Open the Purchase Created in step 2 to alter the unit cost to the new numbers you have, in our case we want to update it to $450.

- Re-enter the sale you have removed, based off the PDF you have saved

Please Note:

In the case that there has been more than one transaction since this purchase, whether it be a sale or a purchase since the purchase you are wishing to alter, you will need to remove all transactions in reverse chronological order. From newest to oldest, when you re enter these transactions after updating your purchase, you will enter these in chronological order (Oldest to newest).

-or-

- Enter a separate transaction to capture the additional expense of $3000.00 that this Item cost your business, as a journal or another purchase (service layout) transaction which you note to be an adjustment. This will mean that the business has still captured this additional cost, however you aren’t booking this against that item.

I have been Purchasing this Product for a long time, and now I need to return Stock and Saasu will not allow me to do this.

It may be that you have recently made a purchase for 5 of the Garden Planter Boxes at $500.00 each, as this price has gone up recently. Your Inventory has since moved on with sales and purchases, however you are needing to return these 5 items as they were damaged. When creating the negative purchase, you are receiving an error to say that you will have a negative current value.

This can happen due to the Average Cost of this item changing over time from the price changes from your supplier, and the number of stock remaining on hand. If you will be removing all stock from hand, the system will require that they Current Value be returned to $0.00.

You may be thinking, I purchased these 5 Garden Planter boxes for $500 each, why can I not return them for $500 each. This is because the average cost of the item is lower due to purchases in the past. The Current Stock Value is based off the number of Items On Hand x the Average Cost.

You can see information on how average cost is calculated here.

To force this in:

You can create an Inventory Adjustment to increase the Current Stock Value, to that of $2,500.00 (5x units at $500.00 each). This will then allow you to return your stock at the correct cost.

You can see detailed information on creating Inventory Adjustments for Writing Off/Adjusting Stock Value within our Inventory Adjustments help article.