Pay items are the components that make up a person’s pay. These parts include tax, take home pay, allowances, superannuation, health benefits, union payments, etc.

The Pay Item list screen shows you a list of the default pay items you get when you sign up for Saasu. You can add and remove from this list, but bear in mind that certain situations will require the inbuilt pay items to be used, in order to generate the correct payslips and required tax reports.

Types of Pay Items

Wage and Salary Pay Item

Generally the core wage components. For example, hourly pay, overtime, bonus or commissions. Generally taxable but seek your own advise for your specific circumstances.

Deduction Pay Item

A deduction pay item can be used to capture Payroll Deduction for your employees. Some examples might include:

- Union Fees

- Disability and Accident Insurance

- Pension / Salary Sacrifice

- Voluntary deductions (e.g. employer loan repayments)

- Charities

- Health Insurance

These may be deductible or non-deductible for tax calculation purposes depending on your specific circumstances.

Entitlement Pay Item

Annual Holiday Leave, Personal Sick Leave and other employee entitlements as per your legal and/or contracted requirements.

Custom pay items

Saasu allows you to set up custom pay items for things such as custom overtime rate, uniform allowances, car, and travel allowances.

You will need to establish with your advisor if the pay item taxable and what tax code if any apply. You will also need to decide whether to include this pay item when calculating certain entitlements or employer contributions. In some cases, you may want to exclude certain wage and salary components when calculating particular entitlements and employer contributions.

To set up custom pay items, select Cog icon > Settings > Payroll > Manage Pay Items. Once you have set these up, you can use them in the default pay and in your payroll transactions.

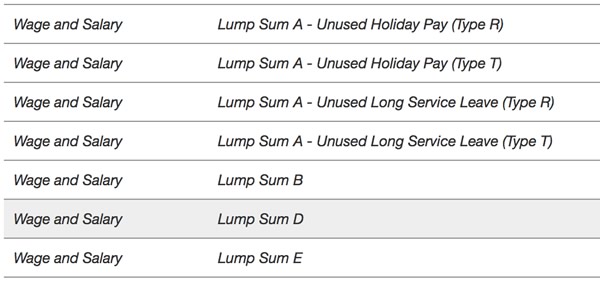

Lump Sum payments

Lump sum payments relate to specific types of payments like employees termination payments above thresholds. It is recommended that payments made to employees, that need to be reported via Single Touch Payroll (STP) or mapped on Payment Summaries to a Lump Sum (A, B, D, E), use the inbuilt Lump Sum pay items. That way when mapping pay items to Payment Summary fields or reporting via STP these amounts can be mapped correctly to the Lump Sum and not Gross Payments.

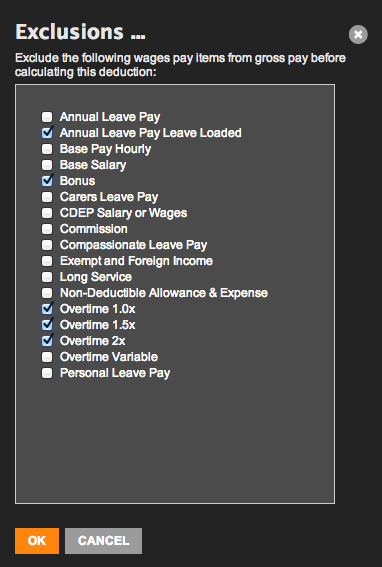

Exclude Pay Items from the Calculation of other Pay Items

Examples:

- You have just set up a uniform allowance wage and salary Pay Item and you want to exclude this from Employer Contribution > SGC Super calculation, which is calculated as 9.5% of gross pay.

- You have just set up a custom overtime rate (eg Overtime 1.25x) and any overtime that falls in this category must be excluded from leave entitlements and SGC Super.

To exclude these pay items:

- Select Settings > Payroll > Manage Pay Items.

- Open each of the pay items you want to apply exclusions to. (In the example above, Employer Contribution > SGC Super, Entitlement > Annual Holiday Leave, Entitlement > Personal Sick Leave).

- Click Exclusions when the pay item is open.

- Tick the pay items that you want to exclude. (In the example above, they would be Uniform Allowance and Overtime 1.25x).

- Click OK to close the dialog.

- Click Save.

Pay Items dependent on other Pay Items

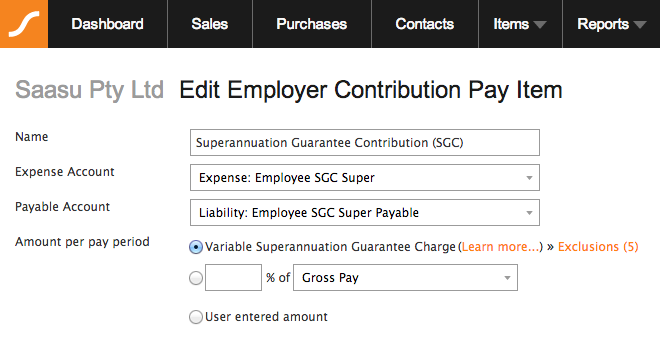

Some Pay Items like superannuation, pensions, or health care may need to use other Pay Items in order to calculate the correct amount. A common example is pension or superannuation payments that relates to a percentage of the gross Wages and Salary Pay Items. Ensure you don’t include the selected Pay items in these calculations if you don’t want to. To see the exclusions for a pay item:

- Click Payroll in the main menu.

- Select Setup Pay Items.

- Click the edit (pencil) icon to access the Employer Contribution pay item.

- Click the Exclusions link to access the list of pay items that are available for exclusion in the pay item’s calculation (those ticked are excluded).

Pay Items that are Variable

Pay Items of the type Employee Entitlements may have an option to choose Variable calculation methods. This is to support government and/or regulator set percentages that apply for particular periods of time in the tax year. Most commonly this applies to Superannuation and Pensions. Behind the scenes Saasu has inbuilt capability to calculate basis specific time periods. These are specific to the zone or country your file is for.