This help item intends to give you some options to account for incorrect pays in Saasu and also the problem that you need to report and fix STP related submissions. You also have obligations to your employees. This is general and educational software guidance and not advice specific to your circumstances. That should be sought from your accountant.

Important things to understand about how STP Pay Event submissions work:

- They rely on the employee details, the pay period, the pay date (payment date) and the YTD numbers.

- The specific Pay Amounts for that pay period aren’t actually reported. This is the ATO’s design, not ours.

- The ATO does not allow you to delete or remove Pay Event submissions. Possibly for audit trail reasons.

- New Pay Event submissions have the effect of updating and correcting the YTD records.

Generally there are legal requirements to provide payslips to employees including adjustments to their pay so please seek advice from your Accountant for your specific circumstance.

Generally you will do adjustments to your employees next pay to fix errors in the previous pay.

Editing (or deleting) an existing pay isn’t usually an option if you have done the following:

- Paid the employee

- Given them a payslip

- Submitted an STP Pay Event

- Part of a Pay Run (because you can only delete an entire Pay Run, not a single pay in it).

Fixing incorrect leave

In the next pay cycle add the a Pay Item line with the amount of negative hours (reverse the incorrect amount of hours) paid in the last pay cycle AND add the Pay Item for Annual Leave Pay taken. Use the Label icon to the right of the pay item(s) to add details required to explain the adjustments to your employee. Here is an example:

Wages and Salaries

Base Pay Hourly 37.5

Base Pay Hourly -3

Adjust Base Pay Hourly

Annual Leave Pay 3

Adjust Annual leave Pay taken dd/mmm/yyFixing incorrect hours paid

In the next pay cycle add the a Pay Item line with the amount of negative hours (reverse the incorrect amount of hours) paid in the last pay cycle. Use the Label icon to the right of that pay item to add details required to explain the adjustment to your employee. Here is an example:

Wages and Salaries

Base Pay Hourly 37.5

Base Pay Hourly -2

Incorrect Overpayment in 21 May 2020 pay.NOTE: This will generate lower pay and thus might reduce the tax calculated. In the previous pay more tax might have been calculated. These amounts may not offset exactly but are in effect recoverable (or payable) in the employees tax return. Please seek advice from your accountant to better understand how this works and if this approach is acceptable for your specific circumstances.

Reversing a pay made to an employee in error

Instead of deleting the pay we will add a new pay transaction that reverses the amounts of the previous pay. Accountants call this a reversing entry. It is like a mirror of the previous pay but the amounts are negative. This creates a net $0 result in your accounts and for the employee records for those two pays.

- Have a copy of the incorrect payslip handy.

- In the main menu go to Add and click Payroll.

- You will be at the Add Payroll Entry screen. Select the Employee from the list.

- Change the Base Pay pay item hours to be negative. i.e. if the pay was 40 hours make it -40. You will see the Amount change to a negative amount.

- For the PAYG Withholding Pay Item uncheck the auto-calc option and manually enter the tax amount as a negative number.

- Verify the Net pay/banked amount is the negative equivalent of the pay you incorrectly paid the employee.

- Verify that the Entitlements Pay Items (Leave Accruals) are negative equivalents also.

- Click Save

Rounding differences in pays

Sometimes you may get a small rounding difference due to the decimalisation of pay rates.

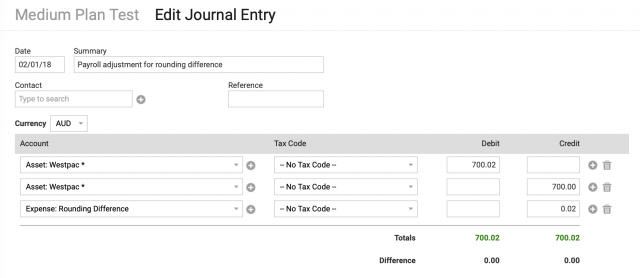

Let’s say your pay run is generating $700.02 but you have paid your employees $700 from your bank account. You won’t be able to match this amount in Bank Feeds.

Here is an example of a Journal used to generate an amount to match against in Bank Feeds but also account for the rounding difference that you can also use to reconcile against if you use the Bank Reconciliations feature in Saasu.

What else do I need to do?

Based on you situation specifically consider if you need to do these things:

Check with your bookkeeper or accountant.

- Provide this payslip to the employee if they are agreeing to repay you the incorrect pay.

- Submit this as an STP Pay Event to update a previously incorrect submission. See STP Mistakes.

- Adjust your next BAS or current BAS if this impacted it.

If in doubt ask your advisors.