Personal Contribution Super is where an employee elects to deduct super from their salary after tax to put into their super fund. They may or may not deduct this later in their tax return subject to ATO approvals. It is not reported via STP generally or as RESC in STP either .

This type of contribution by the employee is not to be confused with Salary Sacrifice Super which is reported via STP as RESC.

The Pay Item setup required to capture this:

- Go to Settings (COG Icon) and select Settings for this file.

- Scroll down to the bottom of the page to the Payroll section.

- Click the Manage Pay Items link.

- Click Deduction at the top of the page to add a new Deduction Pay Item.

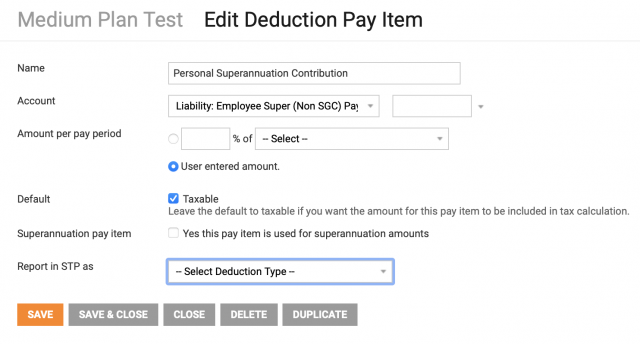

- Setup the Pay Item as per this example below and Save the screen.

Note you may need to create an Account called Liability: Employee Super (Non SGC) Payable.

Saasu uses the Deduction Pay Item type to support various payroll situations, like salary sacrifice, pretax and after tax deductions as well.