From 1 July 2012, businesses in the building and construction industry need to report the total payments they make to each contractor for building and construction services each year. You need to report these payments to us on the taxable payments annual report (TPAR). The requirements to lodge this or not to the ATO are discussed further on their website.

This report will help you report the relevant contractors and values to the ATO. Please seek advice from your Tax Agent for the requirement for your business to have to lodge this report or not.

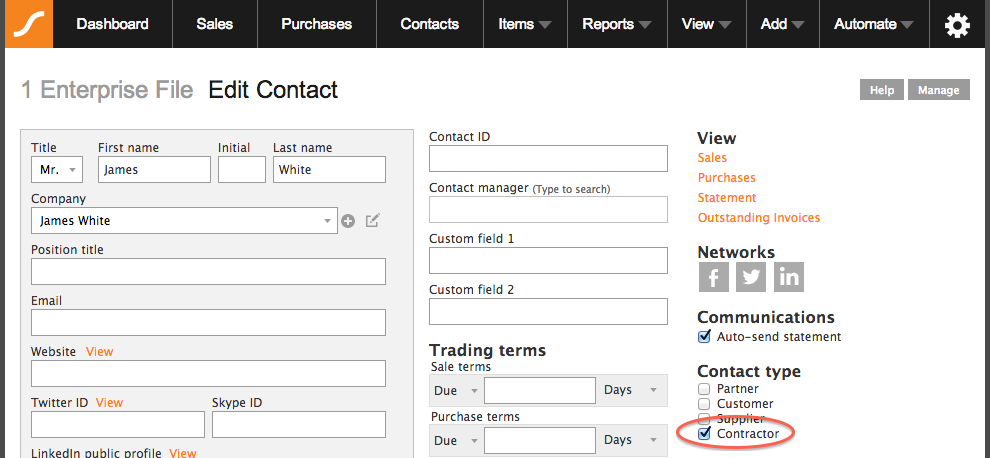

How to get contractors included on the report

Go to Contacts and in each contact that is a contractor, check the “Contractor” type on the right hand side.

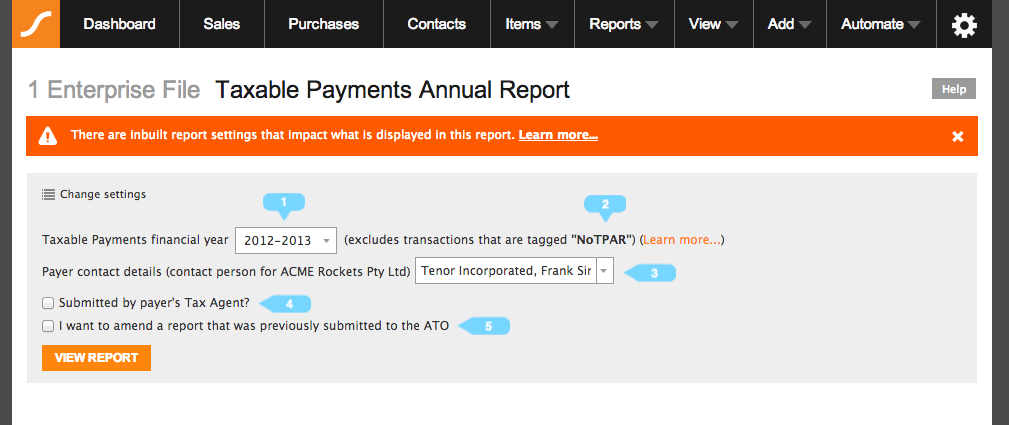

How to run the report

Go to Reports > Tax > Taxable Payments

- Select the relevant financial year

- This denotes that we will include all purchase transactions with a payment against them except those that have been tagged with NoTPAR. See How to exclude certain transactions below for more information.

- Select the contact person for the business this report is for.

- If you as a Tax Agent are completing and will be lodging this report to the ATO, check this box and search for yourself as a contact. (you might have to add yourself as a contact)

- If you have previously lodged this report to the ATO but have to re-lodge it with amendments, check this box.

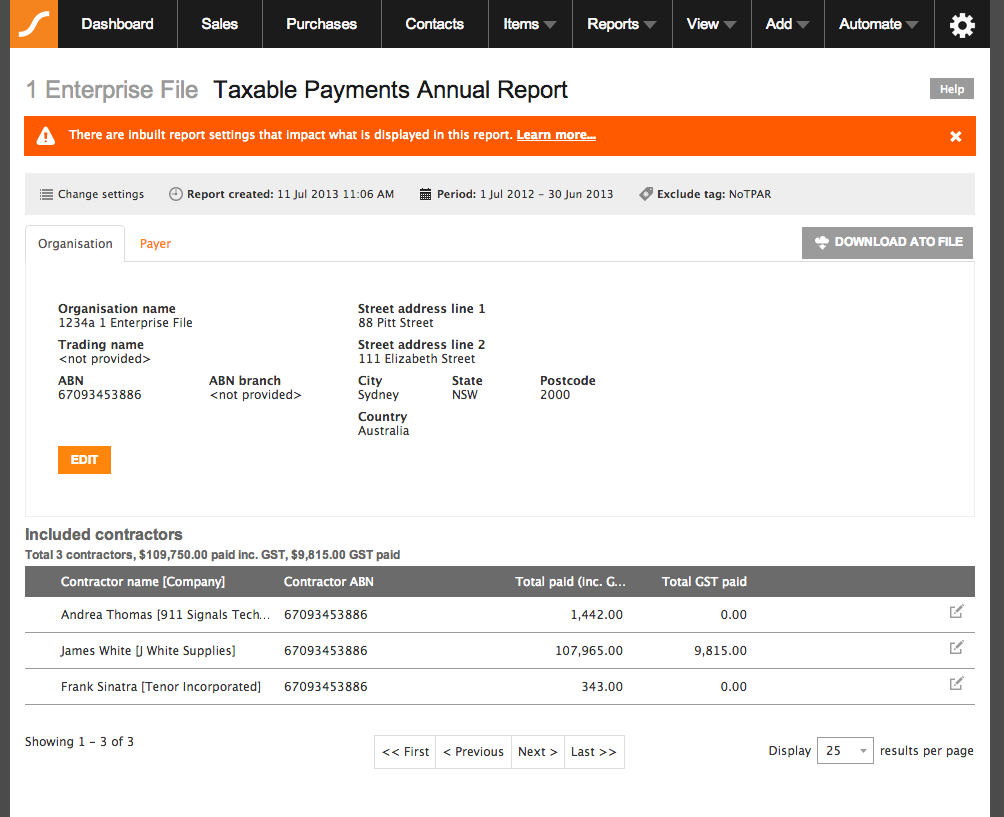

An example of a report with no errors:

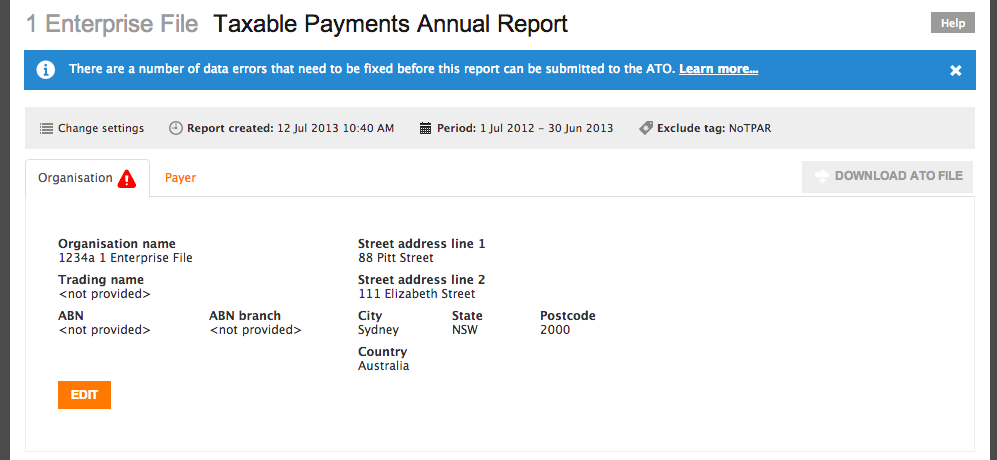

How to fix errors

Once the report is run, we will automatically show you errors that will need to be fixed before you can export the ATO file. You will know which record has a validation error by us showing you a ![]() next to that record. This is done due to the ATO having very strict validation rules for the report.

next to that record. This is done due to the ATO having very strict validation rules for the report.

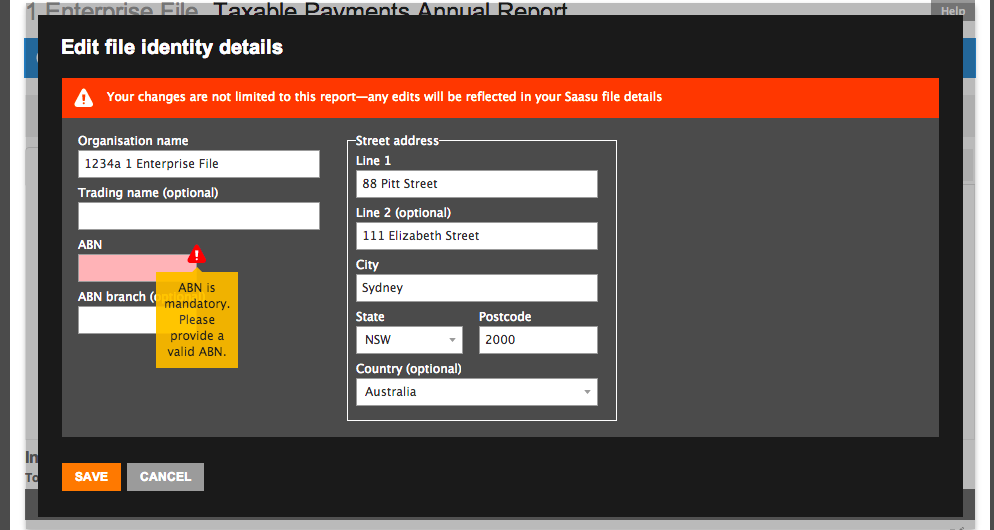

Organisation/Payer/Suppler

If either of these tabs have a validation error, click on the “Edit” icon to bring up a dialogue that will show you the error on the actual field(s). Simply click on the ![]() to see the explanation as to why this field is in error.

to see the explanation as to why this field is in error.

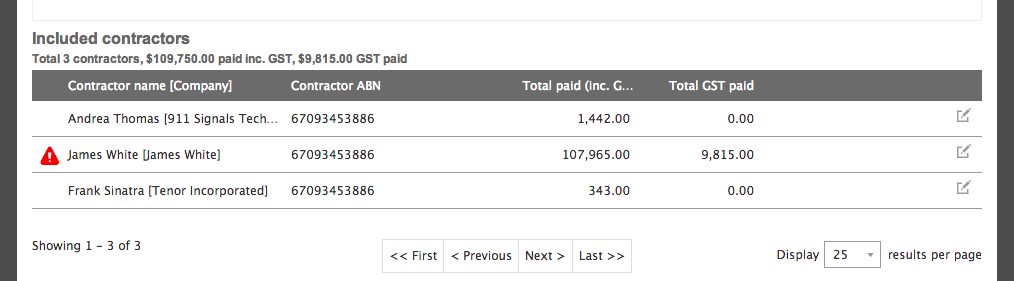

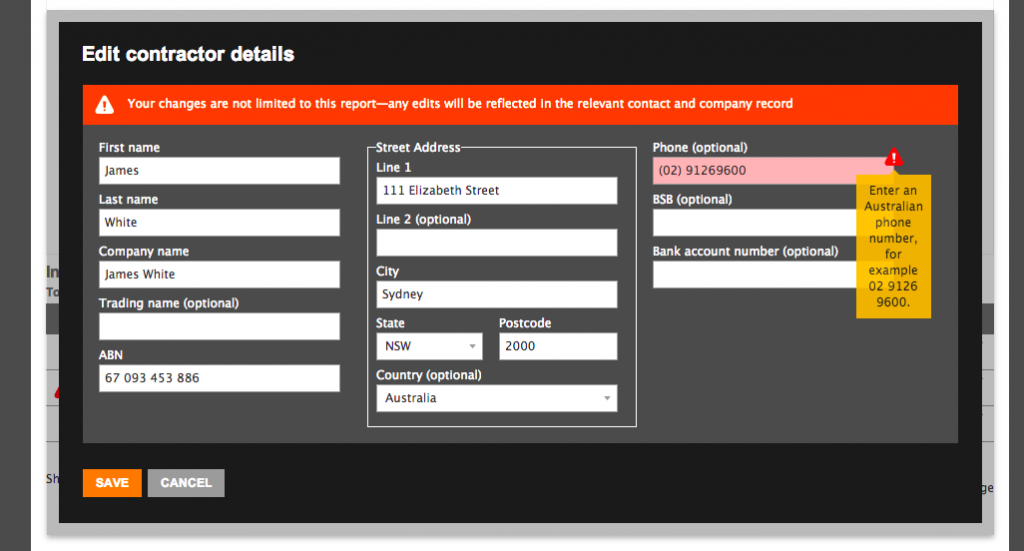

Contractors

Like Organisation/Payer/Supplier, any contractor that has a validation error will have an error on the left hand side of the list of contractors. Clicking on the ‘Edit’ icon on the right column will bring up a dialogue that again will allow you to see the field that is in error, click on the ![]() to see what the error is and fix it.

to see what the error is and fix it.

How to download the ATO file

There are two states for the “DOWNLOAD ATO FILE” button, available to download or not available to download. Not available to download means there are still errors on this report that need fixing and as such you cannot download the report.

Downloadable:

![]()

Not downloadable:

![]()

How to lodge the file to the ATO

For information on how to lodge the electronic file you download above, please see ATO Taxable Payments Reporting.

How to exclude certain transactions

- By default, all purchase transactions including a contractor that have a transaction type of “Tax Invoice” or higher with payments against them will be included.

- If you want to exclude any transactions you will need to add the tag NoTPAR on the transaction as a whole or even on the line item if you want to exclude just that line on the purchase to be excluded.

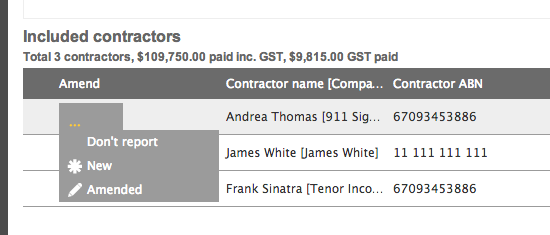

How (and when) to run an amended report

If you have already lodged this report to the ATO but need to lodge an amended report, there will be two scenarios:

- New = there is a new contractor that was not previously reported

- Amended = the amount (GST or total paid) of a previously lodged contractor has changed.

As per note #5 above in “How to run the report”, tick this box when running the report. You will note that once the report is run that in the contractor table there is an extra “Amend” column. Click on the “…” and choose either “New” or “Amended” using the logic above.

Note: you should only lodge new or amended contractors, leave any contractors that are not new or amended as “…” and we will not include them in the ATO file export.