We get queries from Business owners about comparing reports, and they often get very different figures. This is usually due to a number of differences with the types of reports, which is why we always encourage owners to get in touch with their Accountants and work through it together. In many cases, the figures from different reports are used together to understand the Business, and an Accountant is most trained in understanding this.

Difference between Aged Payables and Balance Sheet

If you notice a difference between your Aged Payables report and the Liabilities: Accounts Payable account in the Balance Sheet report, there are a few instances when these two figures can differ.

Journal entries posted to the “Liabilities: Accounts Payable” account

You can easily check this by doing the following:

- Go to View > Journals and filter this page by the “Liabilities: Accounts Payable” account.

- For the date period, make it nice and wide (e.g. 01/01/2000 – today) to make sure you capture any possible errors.

- If you see a journal entry with that filter, then the journal entry figure will be added to the “Accounts Payable” figure in the Balance Sheet and not to the “Aged Payable” report.

- Any journal entry would be causing the discrepancy between the two reports. Either edit or remove the journal entry to fix this discrepancy.

Balance Sheet reporting on invoices doesn’t include Orders

The Balance Sheet won’t show orders so it’s best that you run the Aged Payables report twice to see if any orders are creating this difference.

- Run the Aged Payables for “Orders” only as at the same date as you ran Balance Sheet report

- If a figure is generated in this report, note it down and re-run the Aged Payables report for “All” transaction types and minus the figure that was generated in step one from the total of the report in step two.

- The difference between these two figures can very well be the discrepancy in the two reports.

Stock Value Report doesn’t match Inventory account on Balance Sheet

The Stock Value report lists all inventory on your file, both Active and Inactive items. If there is a value attached to an inactive item it will be included on this report. The Balance Sheet only reports on Active items included on you Inventory accounts.

Differences between Advisor prepared accounts and your Saasu file.

Typically these should be the same as long as the journals or adjustments your accountant make at financial year end each year are also entered into Saasu (or advised to you so they can be entered). This is done as Journal entries. Once captured the two tend to come into line.

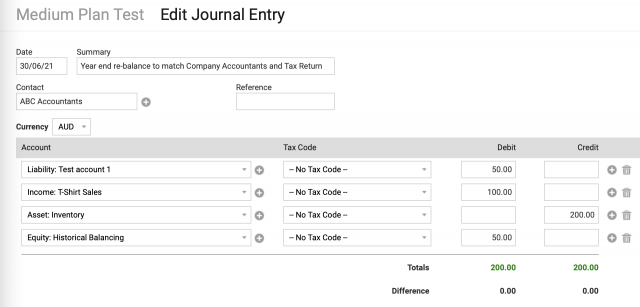

However differences may build over many years and across many accounts if this process isn’t followed each year rigourously. The complexity can compound on itself. If you find yourself in this situation you may need to temporarily align your Saasu account balances to your most recent (accountant prepared) Tax Return and Company Accounts. This can be done with a multi-line Journal (example below) or you can create an individual journal for account adjustment that then allows you to have specific notes associated with it.

You may wish at some point to go back and clean up each year individually but at least having aligned in the present you can move forward in future years from a position of matching your reported Company accounts and Tax Return.

An example of this bulk Journal would be to adjust each account out of alignment and then balance the remainder of the Journal against historical balancing, retained earnings, initial capital or similar. This is essentially where the net accounting error is being held.

Ideally all the adjusting journal lines Debit’s and Credit’s should match and no entry is needed to balance the journal to one of these.

We recommend speaking to your advisor about using this approach to line up your accounts. The above is general and educational and thus we cannot provide specific advice as to how to fix specific accounting errors in your file. Your advisor may also prefer you to more specifically fix prior years.