Saasu released Single Touch Payroll support for users in June 2018. If you are looking for instructions on how to use Single Touch Payroll in Saasu click here.

As per our recent posts, Saasu Single Touch Payroll (STP) reporting will be ready for you to use from July 1st 2018. We are supporting most withholding amounts that are currently reported as part of individual non business payment summaries.

Even though you won’t be reporting your pays to the ATO using STP until after July 1st 2018, there are a few things you can do to get ready.

Enabling STP in Saasu online accounting

There are no special settings that you need to enable STP in Saasu. It will be available on all files and the authentication with the ATO is done behind the scenes. There are some mandatory fields required when each STP report is submitted, so you can be prepared by reviewing and updating those now. Please ensure your file settings has all of your company details, and the state is in short form (i.e VIC, QLD etc), and you have your area code added to your phone number.

Review Employer and Employee Data

Before you start reporting through STP, you should review the data you have for your employees and the file identity data that will be used as your employer information.

In particular check the following:

Review Employer Data

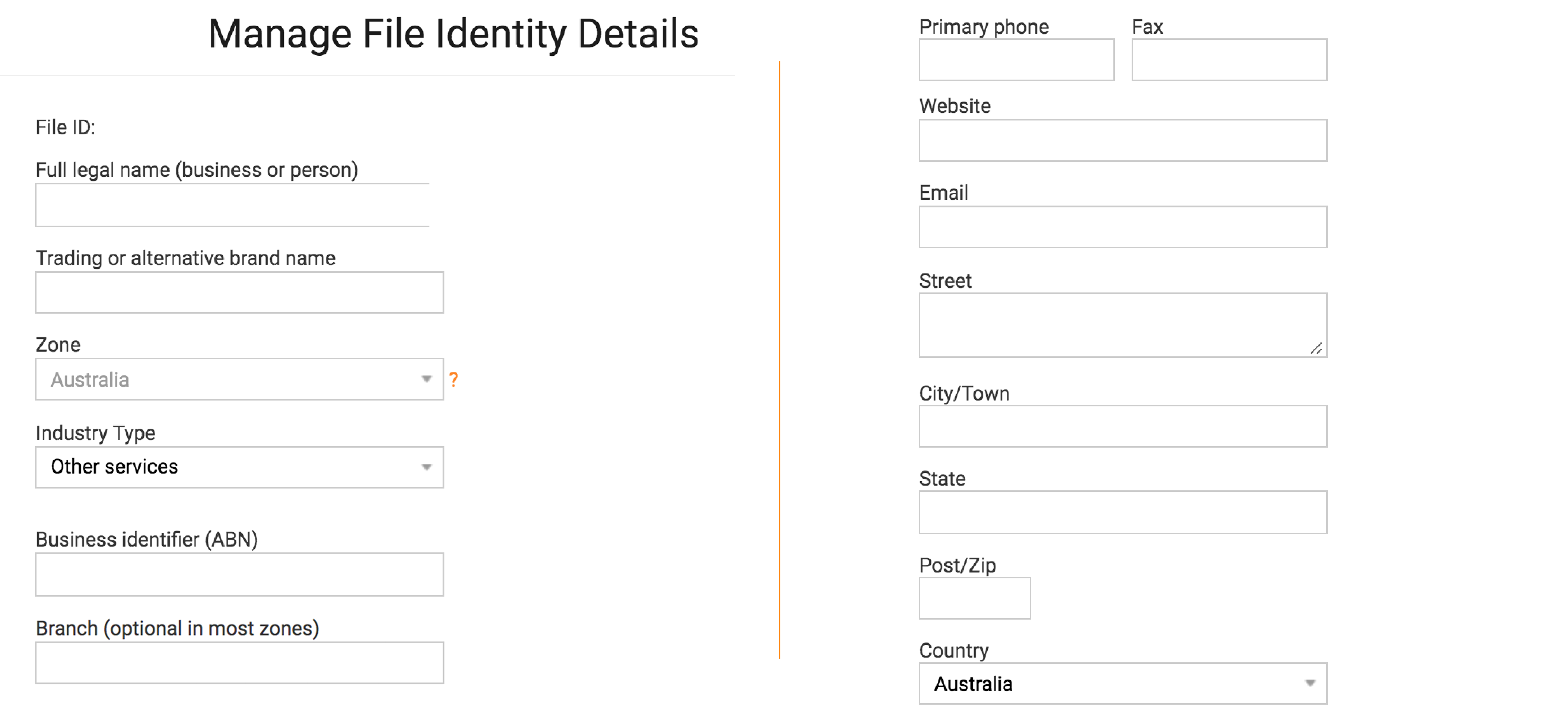

Confirm that your ABN, branch, address (including postcode), and phone number (including area code and no spaces) is entered on the File Identity page (cog icon > Settings for this file > File Identity)

Review Employee Data

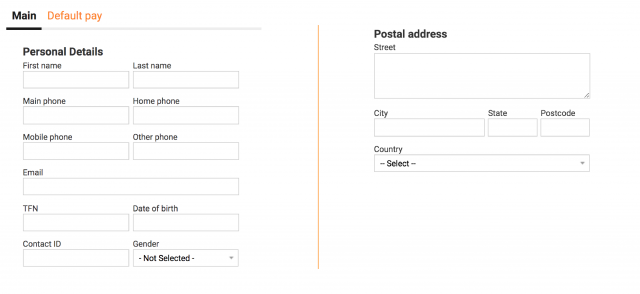

Confirm employee information is accurate – including name, address (including postcode), main phone number (including area code and no spaces), date of birth, and gender, on the Employee Details page (View > Employees > click ‘View or Edit Employee Details’ icon)

Review Pay processes

Check if you are paying employees correctly. This means using the payroll function in Saasu rather than generating pays via journal entries. The STP report that is submitted to the ATO only uses information that is generated from the pay items in payroll entries.

It will be up to you to ensure that the information in the STP report is correct before it is submitted to the ATO. Saasu doesn’t do any validation to see if information is missing or correct.

Setting Up Pay Runs

The Pay Run function in Saasu will be the most effective way to work with STP. So if you haven’t been using Pay Runs, and processing pays by adding individual payroll entries instead, now is to time to setup Pay Runs. Even if you only have a couple of employees, using Pay Runs will make your life much easier when using STP.

Allowances and Deductions

If you have any Allowances or Deductions in your pay items then you will need to specify an Allowance or Deduction Type. You can now start going through your pay items and add the correct Type from the dropdown box for each relevant pay item. Go to (cog icon > Settings for this file > Manage Pay Items).

Lump Sum Payments Pay Items

You will notice, by the end of this week, there are new Pay Items on each file. These are for the reporting of Lump Sum payments for eligible termination payments. We will only be supporting Lump Sum types A, B, D, E. If you have a custom Pay Item setup for these type of payments that you’ve used in the past, then you will need to start using the new inbuilt pay items instead. Only the inbuilt pay items will be picked up in the STP report.

A Sneak Peak

If you are super eager to see how the STP lodgement process happens in Saasu, then here’s a quick look at what to expect.

Submitting a pay event to the ATO via the STP report only takes a couple of extra steps. Once you have processed your pays as per your normal process then you can run the Single Touch Payroll report.

You can run the report using a few different filters depending on what you want to submit. You can select to generate the report on a pay run or for individual payroll entries, and select the particular date range.

Once your STP report has been lodged with the ATO you will be able to view a list of the historical lodgements, with information regarding status, acceptance or failure due to particular errors.

Notify Staff of Changes

You may also find it helpful to advise your employees of the new arrangements, as they will now be accessing their PAYG information via the MyGov website. The ATO has created a resource on STP for Employees.

What do I do if I have more questions on Single Touch Payroll in online accounting?

The ATO website has lots of helpful information. You can also contact the Saasu Customer Experience Team via service@saasu.com if you have any questions about how this affects your particular Saasu payroll setup.