Staying on top of your financials can seem like a lot of work, but it’s crucial for the vitality of your business… and life!

Here at Saasu, we use Saasu as our own business system (it’s the best way to know what we need to build and improve), so I sat with Emma, our Management Accountant, and asked how she manages Saasu’s financials in less than 30 hours a week. Surprisingly, her tips are very simple but very powerful.

Whether you’re a business owner, a staff member, a bookkeeper or an accountant, these are definitely useful to you.

Search

It all starts here. Search can find anything in seconds, so it’s the best way to find journals, payments, invoices, contacts, stock levels, etc.. Given most things we do in the system are repeated, this is the best starting point, instead of wasting time going through menus and filtering through lists. This leads on to the next point.

Duplication

It may seem trivial, but using duplication can save you a ton of time (up to 80% for our business), because duplication takes care of most things.

Duplication of an invoice, for example, is THE major time saving. More often than not, the contact details are the same, description is the same. So by using Jump to get to the invoice and duplicating it saves heaps of time, and it’s so easy to do it that way. In any area. Journals, bank transfers, and more. It makes the system work a lot faster for you.

Do Once Only

We underestimate massively how much time we waste doing repetitive tasks from scratch each time. In fact, it can add up to hours by the end of the week. And there’s no need for it, when you can quickly set up your basic tasks to cover the situations you need, and let the system do the heavy lifting for you from then on. The major time-savers:

- Email templates to deal with most common scenarios

- Invoicing templates to deal with most common scenarios

- Statement templates and other reminders

Very few things are one-offs. Even if you think they are, set them up. We’re sure you’ll use it again. While this may seem like a hassle (it’s actually not that bad), you’ll see the benefits almost immediately.

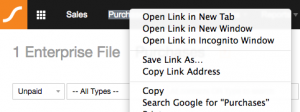

Multiple Tabs Open

This is a simple navigation trick that we’re pretty sure goes under the radar for most users. Surprisingly, having multiple Saasu tabs open saves you a lot of time and frustration too. If you just have your main tabs open, you can perform all tasks without having to press back buttons or choosing a specific menu every time.

Automation

Automate as much of your accounting and admin workload as you can. It really pays off to explore all automation tools available to you. The highlights (these can save you a ton of work):

Reconciliation

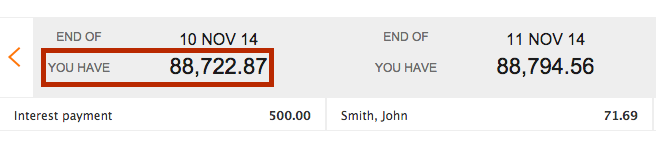

Keeping your records accurate and up-to-date is essential to stay on top of your business.

Your first point of call to achieve this is your bank feeds. Money comes in and out of the business via your bank, so start there and apply payments from within the feed. You can see clearly where your company sits if your bank feed reconciliation is done. This is a process that should be done daily, and it can be pretty speedy, particularly if you use fast coding or bank rules.

Then, depending on your reporting period, run a full bank reconciliation (the old school way) either monthly or three-monthly, depending on the size of your business, to keep everything in order.

Check Future Cashflow

Each week, check your cashflow for the next 30 days (in Forecaster), and chase any overdue payments or create any sales invoices due, so you can boost your position. This helps you keep focused, highlight blind spots and it’s a great tool to help you keep the finger on the pulse and shorten your billing cycle.

Repeatable Processes

Depending on your business, you might have a different monthly checklist to go through, but the one below probably covers most scenarios

- Clearing accounts – They’re created whenever you’re unsure about how to code a transaction. They serve a purpose temporarily, but don’t make these a dumping ground. Clear them out on a regular basis.

- After you’ve done all your accounts work and your BAS (or equivalent in your country), change the warning date on your file, so next time you (or anyone in your team) know not to add any transactions for that period, otherwise your books won’t balance out. At this point, you’ll know your month is closed off.

- Complete all reconciliations for all the bank accounts you’ve set up. If you look at Reports > General Ledger Detail, all accounts that have an * next to them need to be reconciled every month.

- Stay on top of annual leave accrual for the business, as they can cost you a lot of money. It can take a big hit on your cashflow. Inform employees when their leave gets too big. You have to deal with the emotional side of it, as people don’t recognise the impact on the business overall, but it’s worth doing.

Monitor Expenses

Have very clear budgets for different areas (set them up in Saasu), otherwise expenses can get out of control and take a big hit on your cashflow. Consider your recurring purchases. Do it every month. It will pay off in the long run. Keeping an eye on figures is really, really important so you can have a true figure of Profit & Loss.

Gold Tip

Focus on communicating with clients, particularly around billing, supported by a clear process you follow. Communication is key and can make a massive difference to your cashflow.

Lastly, we can’t emphasise this enough. Even if you don’t have time to do anything else, make it a practice to do your bank feeds daily. This way, you’ll always know where your business is at in real-time and it can save you a lot of panic and guess work, as well as support you to make better decisions for you and your business.